ETH Price Prediction: Will Ethereum Break $4,000 Amid Technical and Fundamental Crosscurrents?

#ETH

- Technical Positioning: ETH trades below key moving averages but shows bullish MACD momentum

- Institutional Support: $47M restaking strategy and tokenized fund launches indicate professional confidence

- Market Sentiment: Mixed signals between whale diversification and transparency improvements create uncertainty

ETH Price Prediction

ETH Technical Analysis: Approaching Key Resistance Levels

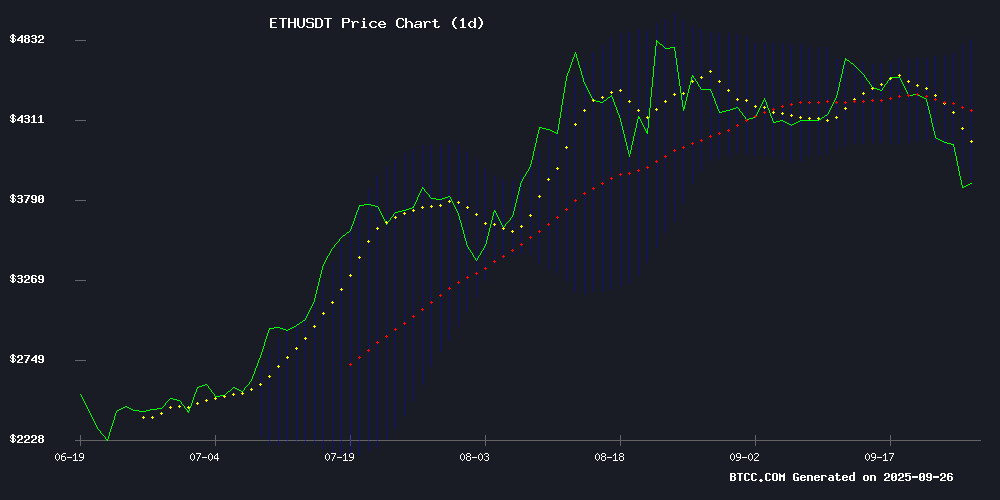

According to BTCC financial analyst Robert, Ethereum's current price of $3,943.91 sits below the 20-day moving average of $4,382.28, indicating short-term bearish pressure. However, the MACD reading of 97.41 shows bullish momentum, while the Bollinger Band positioning suggests ETH is testing lower support levels around $3,937.91. Robert notes that a break above the middle band at $4,382.28 could signal renewed upward momentum toward the $4,000 threshold.

Mixed Market Sentiment as Institutional Interest Grows

BTCC financial analyst Robert observes that recent ethereum developments present a complex picture. While Vitalik Buterin's transparency push and institutional investments exceeding $4,500 provide positive catalysts, whale diversification into alternatives like Remittix and significant trader losses create headwinds. Robert emphasizes that the $47M restaking strategy and tokenized S&P 500 fund launch on Base Network demonstrate growing institutional confidence that could support price stability.

Factors Influencing ETH's Price

Vitalik Buterin Advocates for Transparency in Core Sectors

Ethereum co-founder Vitalik Buterin has issued a stark warning about the dangers of opaque technologies dominating critical sectors such as healthcare, finance, and governance. Centralized systems, he argues, erode public trust and create vulnerabilities. The COVID-19 pandemic exposed these flaws, with closed systems limiting access and fostering skepticism. Open-source alternatives like PopVax demonstrate the potential for greater reliability and affordability.

Buterin highlights the risks of proprietary technologies, particularly in healthcare, where insecure data can lead to severe consequences like blackmail or identity theft. The solution lies in transparent, verifiable infrastructure. Blockchain technology, with its decentralized and open-source nature, could serve as a model for rebuilding trust in these vital systems.

Whale Watch: Massive Losses Shake Cryptocurrency Traders

Cryptocurrency markets have once again demonstrated their ruthless volatility, with billions in liquidations occurring within days. While not officially a bear market, the scale of losses evokes memories of past downturns. Over the past 40 days, another high-profile trader has been wiped out—this time losing $45.3 million on Hyperliquid DEX before exiting with just $450,000 remaining.

The collapse centered on Ethereum's sudden drop below $4,000, which liquidated a $36.4 million long position. Many traders had bet against such a decline, particularly as ETH approached Q4. Meanwhile, Kraken co-founder Jeffrey Wilcke moved 1,500 ETH ($6 million) ahead of the price drop to $3,815—a timely maneuver that contrasts sharply with the carnage elsewhere.

ZA Miner's Free Cloud Mining Platform Democratizes Ethereum Access in 2025

Ethereum's dominance in decentralized applications and smart contracts continues to grow, with 2025 marking unprecedented institutional and retail adoption. Traditional mining barriers—hardware costs, technical expertise, and energy consumption—are being dismantled by ZA Miner's AI-optimized cloud platform.

The service has attracted thousands of U.S. investors by offering GPU-free mining contracts with real-time monitoring. 'We're seeing a paradigm shift where cloud solutions outperform physical rigs in both efficiency and accessibility,' observes a ZA Miner spokesperson. The platform's transparency and automated optimization tools have positioned it as a gateway for novice participants to capitalize on Ethereum's bullish trajectory.

Ethereum Whales Diversify Into Remittix as ETH Struggles to Hold Support

Ethereum faces sustained selling pressure, with its price teetering near the $4,180 support level after an 8% weekly decline. Spot ETF outflows totaling $141 million across major funds like Fidelity and Grayscale exacerbate the bearish sentiment. Technical indicators remain weak, though slowing negative momentum suggests potential consolidation between $4,085 and $4,200.

Meanwhile, large ETH holders are shifting capital to Remittix, a PayFi altcoin that has raised $26.4 million in its ongoing token sale. The project's rapid funding progress and $0.1130 token price are drawing comparisons to breakout launches of previous cycles. Market dynamics reflect a broader rotation from established assets into high-growth narratives during this quarter's volatility.

Ethereum Surges Past $4,500 Amid Renewed Institutional Interest and DeFi Growth

Ethereum breached the $4,500 threshold, reigniting discussions about its institutional adoption and utility beyond Bitcoin. Analysts attribute the rally to expanding decentralized finance (DeFi) applications and asset tokenization, though volatility risks remain elevated.

FY Energy, a cloud mining platform, capitalizes on the momentum by offering USD-denominated daily payouts without hardware requirements. The service provides a $20 trial bonus for new users to test short-term mining contracts with 24-hour settlement.

Mining contract tiers cater to retail and institutional participants, though the platform's promotional claims about consistent 4% daily returns warrant scrutiny given cryptocurrency market realities.

ETHZilla Deploys $47M in Ether to Puffer for High-Yield Restaking Strategy

ETHZilla Corporation (Nasdaq: ETHZ) is making waves in decentralized finance with a $47 million Ether deployment into Puffer's liquid restaking protocol. The move signals institutional confidence in Ethereum's yield potential while showcasing innovative treasury management strategies.

Puffer's technology combines validator security with liquid staking flexibility, offering ETHZilla enhanced returns on its Ethereum holdings. This partnership reflects growing demand for sophisticated DeFi solutions among publicly traded companies.

The restaking initiative positions ETHZilla at the forefront of Ethereum's evolving financial infrastructure. Such large-scale deployments demonstrate how traditional finance methodologies are merging with blockchain-native yield strategies.

Centrifuge Launches Tokenized S&P 500 Index Fund on Coinbase's Base Network

Centrifuge, a leader in real-world asset tokenization, has unveiled the first licensed S&P 500 index fund on blockchain. The Janus Henderson Anemoy S&P 500 Fund (SPXA) launched on Base, an Ethereum layer-2 network developed by Coinbase, marking a milestone in institutional crypto adoption.

The fund brings 24/7 trading and transparent holdings to one of the world's most tracked equity benchmarks. FalconX served as anchor investor, with Wormhole facilitating cross-chain expansion. Janus Henderson, managing nearly $500 billion in assets, acts as sub-investment manager.

This initiative accelerates the RWA (real-world asset) movement, demonstrating blockchain's potential to transform traditional finance through operational efficiency and global accessibility. Centrifuge leverages its six years of tokenization expertise to bridge Wall Street and decentralized finance.

Will ETH Price Hit 4000?

Based on current technical indicators and market developments, ETH faces both opportunities and challenges in reaching $4,000. The current price of $3,943.91 requires approximately 1.4% upside to breach this psychological level.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $3,943.91 | Neutral |

| 20-day MA | $4,382.28 | Resistance |

| MACD | 97.41 | Bullish |

| Bollinger Lower Band | $3,937.91 | Support |

Robert suggests that while technical resistance exists, growing institutional interest and DeFi developments could provide the necessary momentum for a $4,000 test in the near term.